Managing finances effectively is a crucial aspect of a stable and stress-free life. The key to attaining financial stability and control of your finances is to have a well-organized budget. Fortunately, household budget templates offer a practical solution to streamline your financial planning and ensure your hard-earned money is utilized wisely.

Importance of Household Budgeting Templates

Having a professional budget gives you a clear picture of your income, saving, and expenses. Eventually, help you to keep a portion of your income aside and allocate proper money to household expenses. Household budget templates come with various advantages, such as time-saving, simplified organization, and the ability to customize according to your unique financial situation.

Choosing the Right Household Budget Template:

Assessing Your Financial Goals

Before selecting a budget template it is inevitable to figure out your short and long-term financial goals and then opt for the one household budget template accordingly.

Identifying Your Income and Expenses

Accurately evaluating your income sources and differentiating between fixed and variable expenses will help in creating a realistic budget.

Analyzing Budgeting Methods

Explore various budgeting methods to find the one that aligns with your lifestyle and ensures maximum efficiency in managing your finances.

Free Household Budget Templates:

Popular Household Budget Templates:

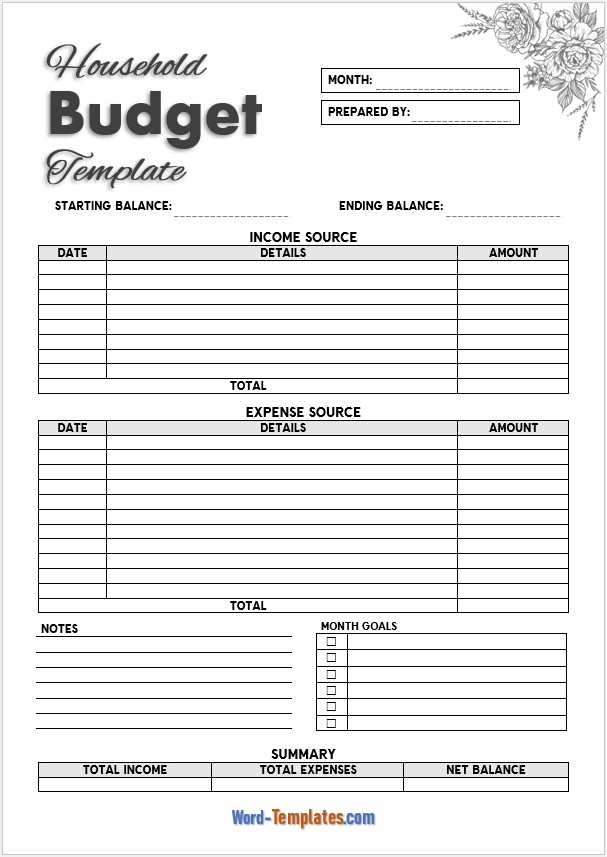

Monthly Household Budget Templates

Analyze your income and expenses every month using this template, allowing you to plan accordingly and make adjustments as needed.

Zero-Based Budget Templates

With this method, you allocate every dollar of your income, ensuring no money goes unaccounted for and promoting better financial discipline.

Envelope Budget Templates

An old-fashioned yet effective way to manage finances, this template involves using cash envelopes for different spending categories.

50-30-20 Budget Templates

This budgeting rule allocates 50% of your income to essentials, 30% to discretionary spending, and 20% to savings and debt repayment.

How to Use Household Budget Templates Effectively?

Gathering Financial Information: Collect all relevant financial data, including bills, receipts, and statements, to get a clear picture of your financial standing.

Setting Realistic Goals: Establish achievable financial goals and milestones to stay motivated and focused on your budgeting journey.

Tracking Income and Expenses: Record all income and expenses meticulously to identify potential areas for improvement and ensure you stick to your budget.

Adjusting and Revising the Budget: Life is dynamic, and so are your financial needs. Regularly review and adjust your budget to accommodate changes and unexpected events.

Tips for Successful Household Budgeting:

Categorizing Expenses

Organize your expenses into categories to gain better insights into your spending habits and identify areas where you can cut back.

Creating an Emergency Fund

Prepare for unforeseen expenses by setting up an emergency fund covering three to six months’ living expenses.

Avoiding Debt Traps

Learn how to manage credit responsibly and avoid falling into the trap of excessive debt that can strain your budget.

Reviewing Your Budget Regularly

Evaluating your budget is important to stay on the right financial track and once you feel the need to make a crucial financial decision go for that.

Incorporating Savings and Investments:

Understanding the Importance of Savings

Learn the significance of saving money and how it contributes to financial stability and future financial endeavors.

Exploring Investment Options

Explore different investment opportunities to grow your wealth and secure your financial future.

Building Retirement Funds

Start planning for retirement early by setting aside a portion of your income for your golden years.

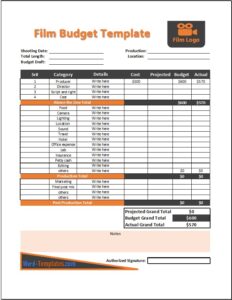

Budgeting for Special Circumstances

One should learn how to manage budgeting when your income fluctuates, such as during freelancing or self-employment. Furthermore, effective budgeting strategies for families with children help them in changing household dynamics. Similarly, you should also prepare for unexpected financial emergencies by incorporating contingency plans into your budget.

How Technology Can Enhance Budgeting?

Budgeting Apps and Tools

Explore modern digital solutions that simplify budgeting and offer valuable insights into your spending patterns.

Automating Your Finances

Discover how automating bill payments and savings contributions can streamline your financial management.

Integrating Budget with Personal Finance Apps

Learn about apps that combine budgeting with financial planning, investment tracking, and debt management. In this manner, online personal budgeting templates can also help you a great deal.

Instilling Good Financial Habits:

Teaching Kids about Budgeting

Equip the next generation with essential financial skills by introducing budgeting concepts early on.

Cultivating Mindful Spending

Adopt mindful spending practices to prioritize value-based expenses and eliminate unnecessary splurges.

Seeking Professional Financial Advice

One can also take help from a financial advisor to get guidance for managing financial matters.

How to Avoid Common Budgeting Mistakes?

Underestimating Expenses: Avoid underestimating expenses and create a realistic budget that encompasses all financial obligations.

Neglecting Financial Goals: Stay committed to your financial goals by regularly monitoring your progress and making necessary adjustments.

Failing to Adapt to Changing Circumstances: Be flexible with your budget and adjust it as your financial circumstances change over time.

The Psychological Aspect of Budgeting:

Overcoming Money-Related Stress

Address the psychological aspects of budgeting to reduce stress and develop a healthy relationship with money.

Celebrating Budgeting Success

Acknowledge and celebrate your budgeting achievements to stay motivated on your financial journey.

Staying Motivated Throughout the Process

Stay motivated during challenging times by reminding yourself of the financial freedom and security that budgeting brings.

Building a Long-term Financial Plan

These templates will help you establish long-term financial milestones and work towards achieving them with disciplined budgeting. Moreover, you will also be able to plan and save for significant life events, such as buying a house, starting a family, or pursuing higher education. Not only that, with the help of these templates you can also implement effective debt repayment strategies to free yourself from financial burdens.

Conclusion

A household budget template is a powerful tool that allows you to check your finances and make rational financial decisions. By utilizing various household budget templates and adopting good financial habits, you can achieve your financial goals, reduce stress, and build a secure future.