There are some people who feel that they don’t really need a budget because they spend all the money that they have in a single month. What they do not know is that they are spending more than they should. When you have a monthly budgeting scheme, you are able to keep track of your spending. The good thing about it is that you can also increase your savings if you can effectively plan your money for a month. However, monthly budget templates help you out of the danger of extra monthly expenses.

Tips to Prepare a Perfect Monthly Budget

A perfect monthly budget enables you to track all of your expenses. In this way, you can spend your money efficiently and smartly and you can also save your money by defining some boundaries for your expenses. Creating a monthly budget is not a big deal.

Here we have provided some tips to help you out:

Include a Spending Graph:

You can include a detailed spending graph in your notebook. It is a good idea to do this when you want to make a paper trail (to avoid being charged for making a paper trail). In the example, you will be able to document every single penny that goes out or goes into your account.

Include a Trending Graph:

You can create a trend on your budget and either draw trends or label the days that you spent more or less money. The good thing about this is that you will be able to monitor the trend. This will allow you to have an idea if there is really a money-saving opportunity in the upcoming months or not. You can also use the trend to find out the average amount of money that you are currently earning.

Use a 30-Day Rule:

You can apply the 30-day rule. It means that if you spend money in one month, you must save money in the next month. In other words, you should always have your money set aside for a month.

Set-Up goals:

You can start by creating a list of your short-term and long-term goals and write down your dreams and aspirations. This term also helps you to create goals based on your current financial situation. Be as specific as possible.

Get Creative:

Just remember that your goal is to reduce your expenses so that you will be able to have enough money for all of your financial needs. Budgeting doesn’t mean just setting limits for yourself. It is also about creating opportunities. That is how you will be able to live comfortably even if you are a little behind on your monthly budgeting.

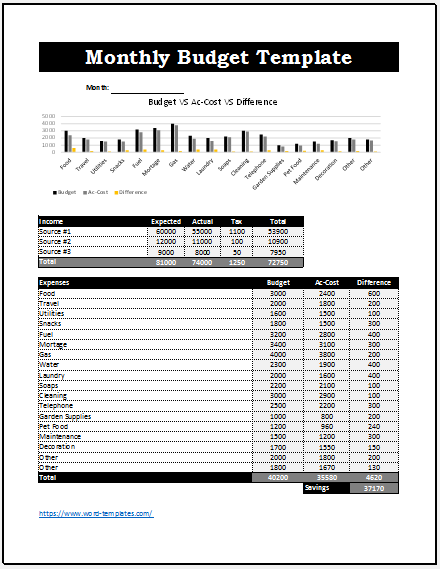

Free Monthly Budget Templates

To help you out, we have listed some free and high-quality monthly budget templates below. All of these templates are available in MS Excel Format. These templates contain formulas to perform calculations. Meanwhile, you just have to put your data in the template and your budget will be ready in a few seconds. So hurry up..! and get these free templates.

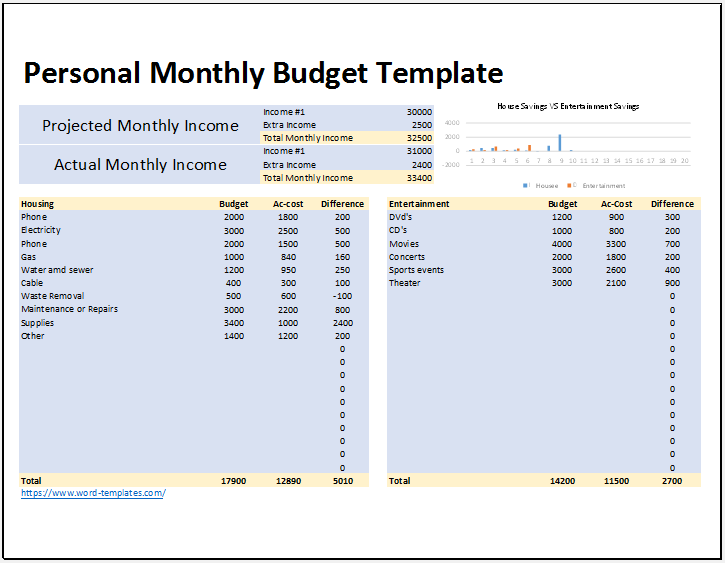

Here is the download link for this Monthly Budget Templates 01 in MS Excel format.

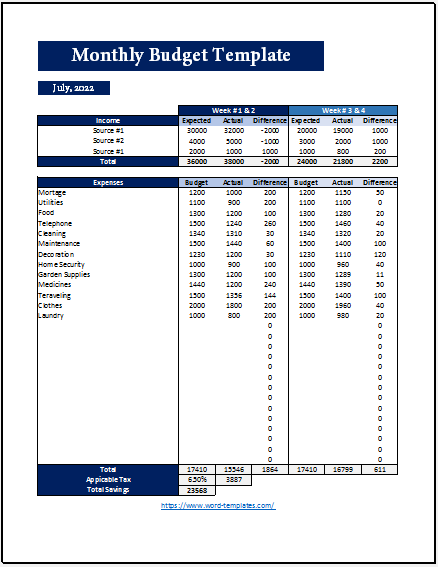

The download link for this Monthly Budget Template 02 in MS Excel format is below.

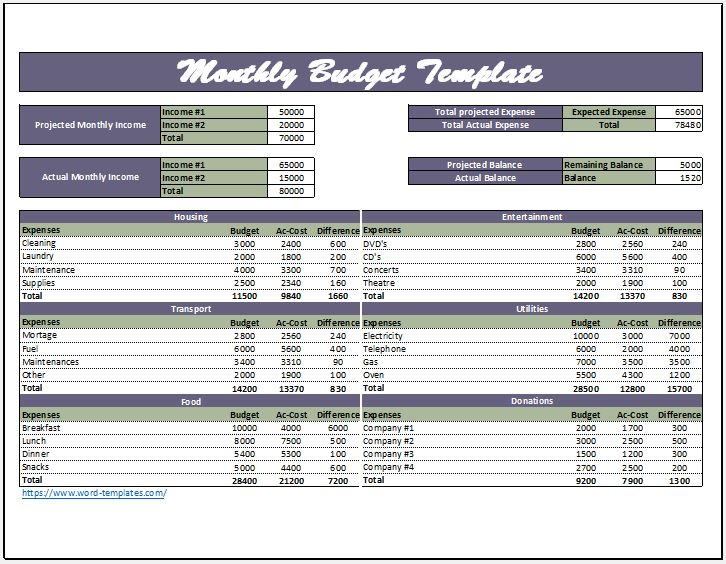

Please click on the download button below to start downloading this Monthly Budget Template 03.

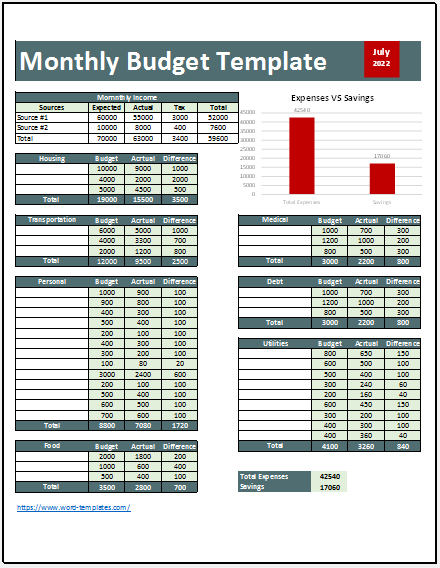

To download this Monthly Budget Template 04, click on the button below.

Please click on the button below to start downloading this Monthly Budget Template 05.

To download this Monthly Budget Template 06, click on the button below.

Please click on the button below to start downloading this Monthly Budget Template 07.

Benefits of Monthly Budget Templates

For those people who are having a hard time planning monthly budgets, there are actually templates that you can use. Budgeting helps you track your finances easily. You will find it very useful when you are planning a monthly budget. A perfect template will not only make you save time but also give you lots of advice for making your budgeting plans easier.

There are actually lots of tools that you can use for budgeting. Some people would rather use the traditional forms of budgeting like the National Debt Clock or the Family Budget Worksheet. If you prefer a more hands-on approach, you can actually use an interactive budgeting tool like Quicken by sense. This tool will help you create monthly budgets using categories and you can also make adjustments as you go along. It is a lot of fun to use this budgeting tool!

Know how much money you have and where you are with your finances. Knowing where your money is, will make it easier to know what you need to spend. If you know this, then you can make budgeting decisions. You will also be able to make adjustments if necessary.

So, if you want to save time with your budgeting and be able to spend more time doing the things you really enjoy, you should start to plan a monthly budget. This will definitely help you out in the long run. Just be sure that you start planning at least six months before the end of the month. This will give you enough time to think about what to put in your monthly budget. Remember that if you don’t plan, you will just end up living paycheck to paycheck. That is definitely not a good way to live!

![Free Monthly To-Do List Templates [DOCX] monthly to do list template 01](https://www.word-templates.com/wp-content/uploads/2024/08/monthly-to-do-list-template-01-233x300.jpg)