In the fast-paced global of academia, college students often discover themselves juggling more than one obligation, consisting of coursework, component-time jobs, and social activities. Amidst those challenges, dealing with a budget can become overwhelming. This is where student budget templates come to the rescue. So, now we are going to elaborate on the importance of budgeting for students and how to generate these student budget templates to bring financial control and prosperity.

Why Student Budgeting Matters?

Navigating via the educational segment of lifestyles may be financially traumatic. From lesson fees to textbooks, housing, and day-by-day expenses, the economic burden on students is simple. Without a proper budgeting strategy, it is smooth to overspend and fall into debt, which may have lengthy-lasting results. Therefore, learning budgeting capabilities all through learning years lays a sturdy basis for future economic independence.

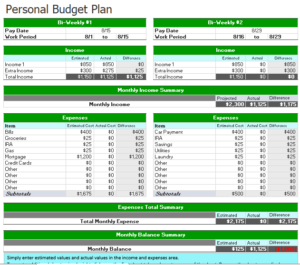

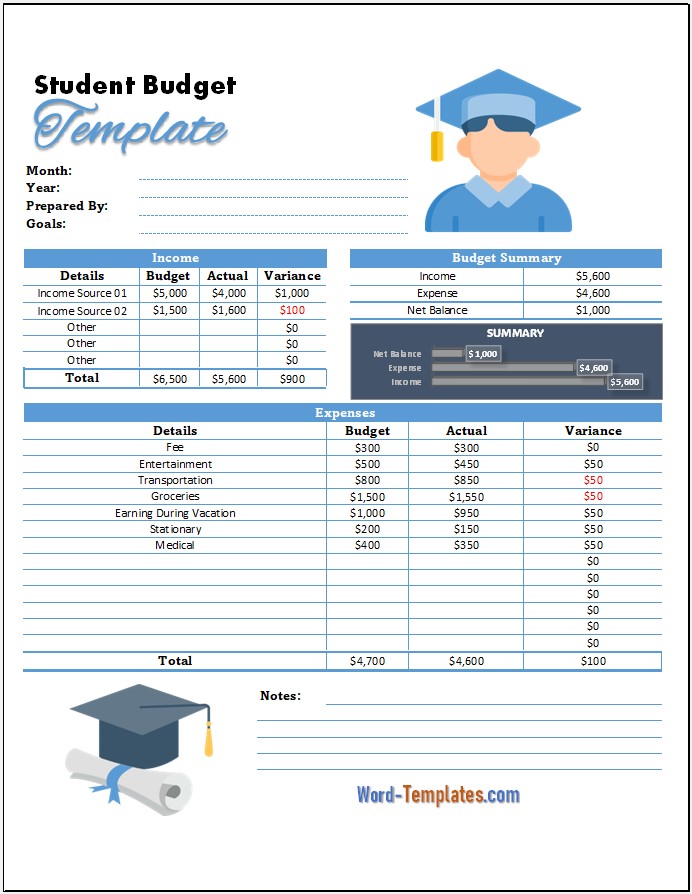

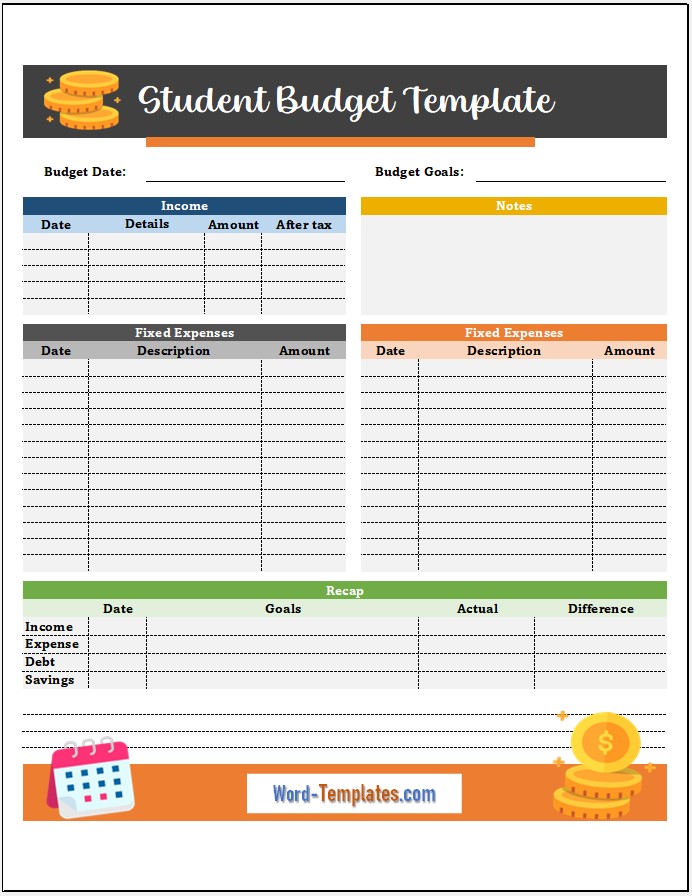

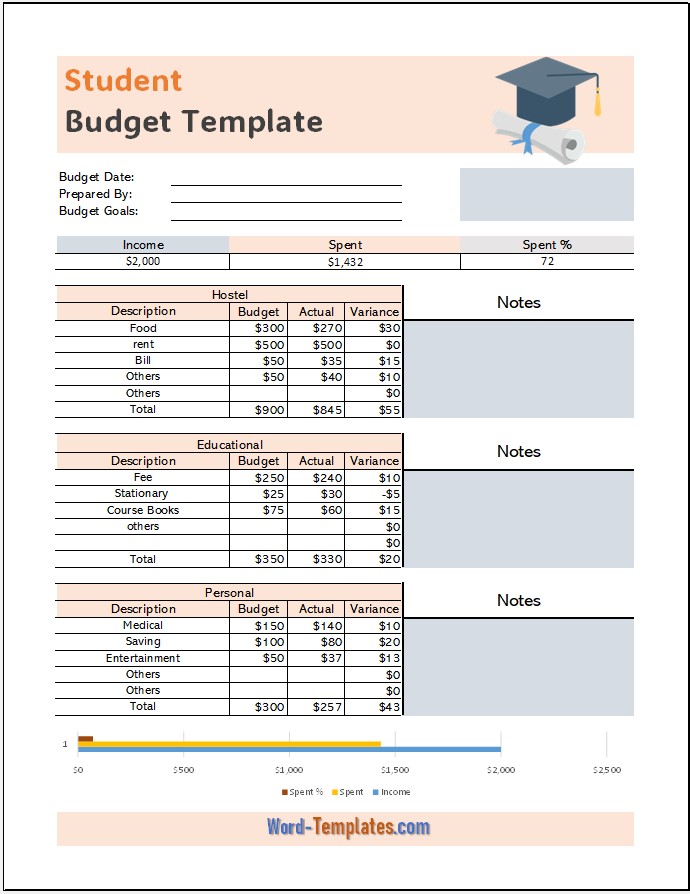

Free Student Budget Templates:

The Benefits of Student Budget Templates

Organization and Clarity

Easy Customization of Student Budget Templates

Enhanced Control and Discipline

Creating Student Budget Templates

- Step 1: Assess Your Income

- Step 2: Identify Fixed Expenses

- Step 3: Allocate for Variable Expenses

- Step 4: Set Savings Goals

Long-Term Financial Planning for Students

Building an Emergency Fund: An emergency fund covers surprising scientific bills, vehicle upkeep, or unexpected tour prices.

Establishing Credit Responsibly: Start constructing a top credit score by way of using a credit score card responsibly and making bills on time.

Setting Financial Goals Beyond College: Plan for existence after commencement. Set desires for paying off student loans, saving for a vehicle or a home, and starting retirement investments.

Examine Different Budgeting Methods

Here you can explore different budgeting methods to help you out in planning and creating as per your requirement.

50/30/20 Rule

This approach indicates allocating 50% of your profits to needs, 30% to desires, and 20% to financial savings and debt payments.

Zero-Based Budgeting

With zero-primarily based budgeting, each dollar has a cause. Allocate your earnings until you reach zero, ensuring each penny is accounted for.

Envelope System

Allocate cash to exclusive envelopes for specific categories. Once the envelope is empty, that’s your budget limit for that category.

Staying Disciplined and Adapting Your Student Budget

- Regularly overview your budget to make sure you are heading in the right direction. Life circumstances trade, so be equipped to evolve.

- Budgeting may be difficult, especially at some point in examination intervals or on unexpected occasions. Stay devoted and bendy.

- Acknowledge your achievements, whether or not it’s paying off a credit card or accomplishing a financial savings aim. Rewarding yourself keeps you stimulated.

Conclusion

In the arena of higher schooling, learning the artwork of budgeting is an ability that may significantly impact a student’s average properly-being. Student budget templates function as valuable equipment to navigate the monetary demanding situations of scholar existence. By keeping a near eye on your budget range, you may accomplish economic goals, dispose of stress tiers, and climb up closer to your future. Therefore, using student budget templates during an educational career is highly significant.