Download these Free Credit Reminder Templates to create and print your own Credit Reminders. Moreover, you can also download these Cash Receipt Templates for printing your day-to-day cash receipts easily.

You’ve heard the old saying: if you want it done right, do it yourself. If you’re not an expert on credit, you know that this advice couldn’t be more true. The process of setting up a credit reminder calendar is a daunting task when you have no credit or bad credit history. In order to expedite the process of getting your financial life back on track, you need a template that will guide you through every step of the process.

Credit reminders are a great way to stay on top of your credit card payments. Most people don’t keep track of their bills and only discover late fees or missed payments years later. With these documents, you can print a bill reminder the day before your due date so you never miss a payment. The next time you receive a bill, you can review it to ensure you paid it. Or, you can even use it as a guideline so you always know how much you should be paying each month.

Free Credit Reminder Templates

Credit reminder templates are great tools because they save you a lot of time and hassle. You don’t have to sit down at a computer and enter all of your information manually. No more trying to figure out how to add one more card to your credit card portfolio. You can have all of your information at your fingertips in just a few minutes. Using a template format for your credit card reminders saves you essential time, stress, and paper. You want a format that makes entering your information as easy as possible. That’s why we have a collection of Credit Reminder Templates for you. These templates are created in MS Word formats so you can easily put your required details and make them your own.

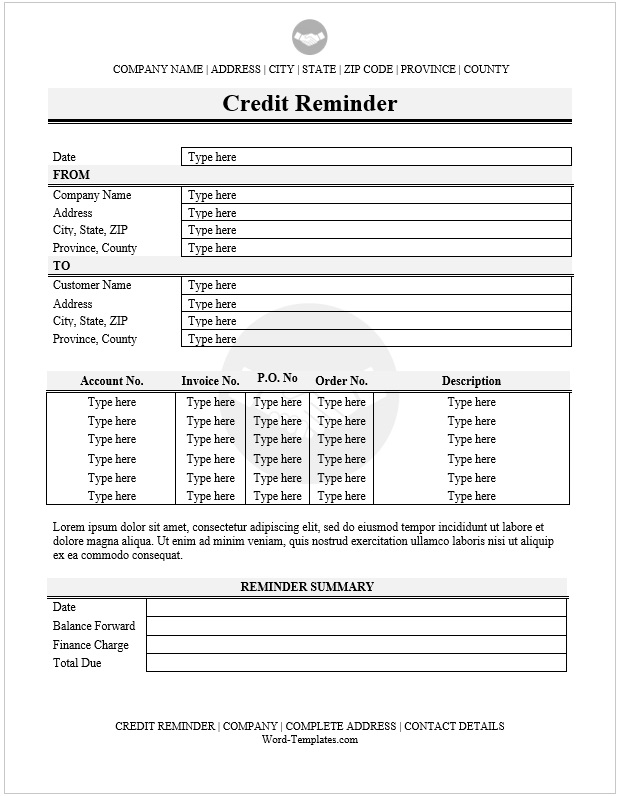

Download this printable credit reminder template from the link below.

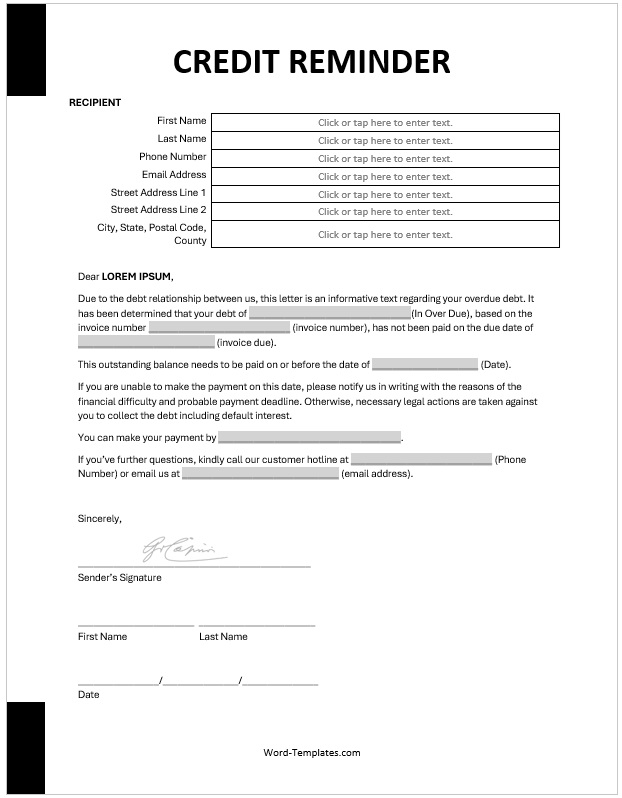

You can download this professional credit reminder template from the link below.

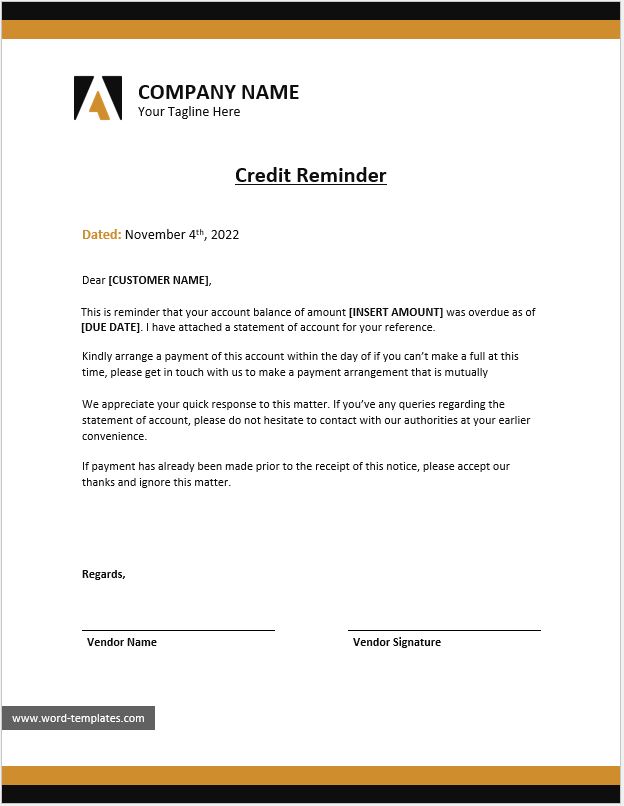

Click on the download button below and get this Credit Reminder Template as a freebie.

What a Credit Reminder!

A credit reminder is a formal document sent by the vendor to customers for the payment due. It is a gently written letter that is sent before the past due notice and taking any legal action against the customer. This particular letter contains details of the customer’s purchase and payments with reference to the date and time. It is an important document used in business correspondence for giving notice to customers. If there are such accounts that are not updated and credited, when annual credit checking is conducted on behalf of the organization, they are monitored by the account officers. A credit reminder is just like a notice that a customer has to accomplish on his/her behalf.

Credit reminder is generally prepared by accountants and cashiers who monitor financial transactions closely. The preparation of such notices and letters depends on their size and type and it varies accordingly. In the preparation of such reminders, designing, and format are considered the most important point to be followed by the concerned person. If you are given the responsibility to prepare credit reminders that should be very professional also. You may need to have an idea of how to design a professional-looking and appealing credit reminder that is highly considered one of the business documents. You may not need to worry about this. You can get help from our templates that are created for this specific purpose. However, the following templates are well-designed and professional-looking to prepare credit reminders for your customers.

Benefits of Using Credit Reminder Templates

Credit Reminder Templates will come in handy for so many different reasons. If you are getting ready to purchase a car or home, you will need to keep track of your debt to determine how much you can afford. You may even want to set up a budget for yourself or your family to ensure you are staying on track and reaching your financial goals. Regardless of why you are using the templates, you’ll find them invaluable.

You can also use Credit Reminders as a guide when considering new purchases with credit cards. For example, if you are planning to purchase a large television, you should not borrow money on the card until you have at least cleared your current outstanding balance. Doing so could result in costly interest charges. You can easily use the Credit Reminder to calculate how much you will need to pay for the television, then use it as a guideline when shopping for the item. This will not only save you money on interest, but you will also know that the amount you are borrowing is affordable.

If you have many credit cards, you may find it difficult to keep up with the accounts. This is where a Credit Reminder can come in handy. Using it to track expenses and debts can help you make sure you are meeting all of your monthly obligations. It also allows you to determine if a debt is becoming too much. If so, you can usually make the required changes so the debt is more manageable.